- Available now

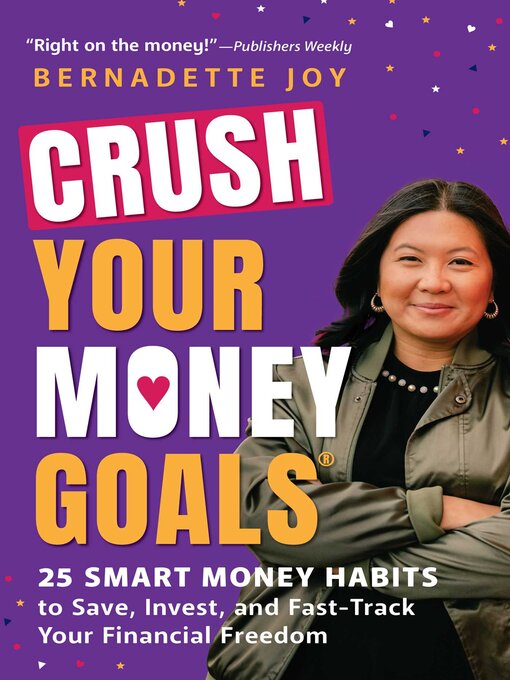

- New eBook additions

- Superloan eBooks

- New kids additions

- Captivating Lives on eBook

- Readers for Adult Learners

- See all ebooks collections

- Available now

- Superloan eAudiobooks

- New audiobook additions

- New kids additions

- New teen additions

- Captivating Lives on Audio

- See all audiobooks collections